- Basis Points

- Posts

- Could this be a bubble? The state of the AI story

Could this be a bubble? The state of the AI story

Enjoy this email? Help us grow by forwarding it to another adviser that you think will enjoy it. The larger Basis Points gets, the better guests we can get on the show.

The Equity Mates network reaches more than 750,000 young Australian investors each month. For advisers, these are the next generation of clients. This monthly email shares insights to help bridge the gap between young Australians and financial advisers.

Is 2025 starting to look like 2000?

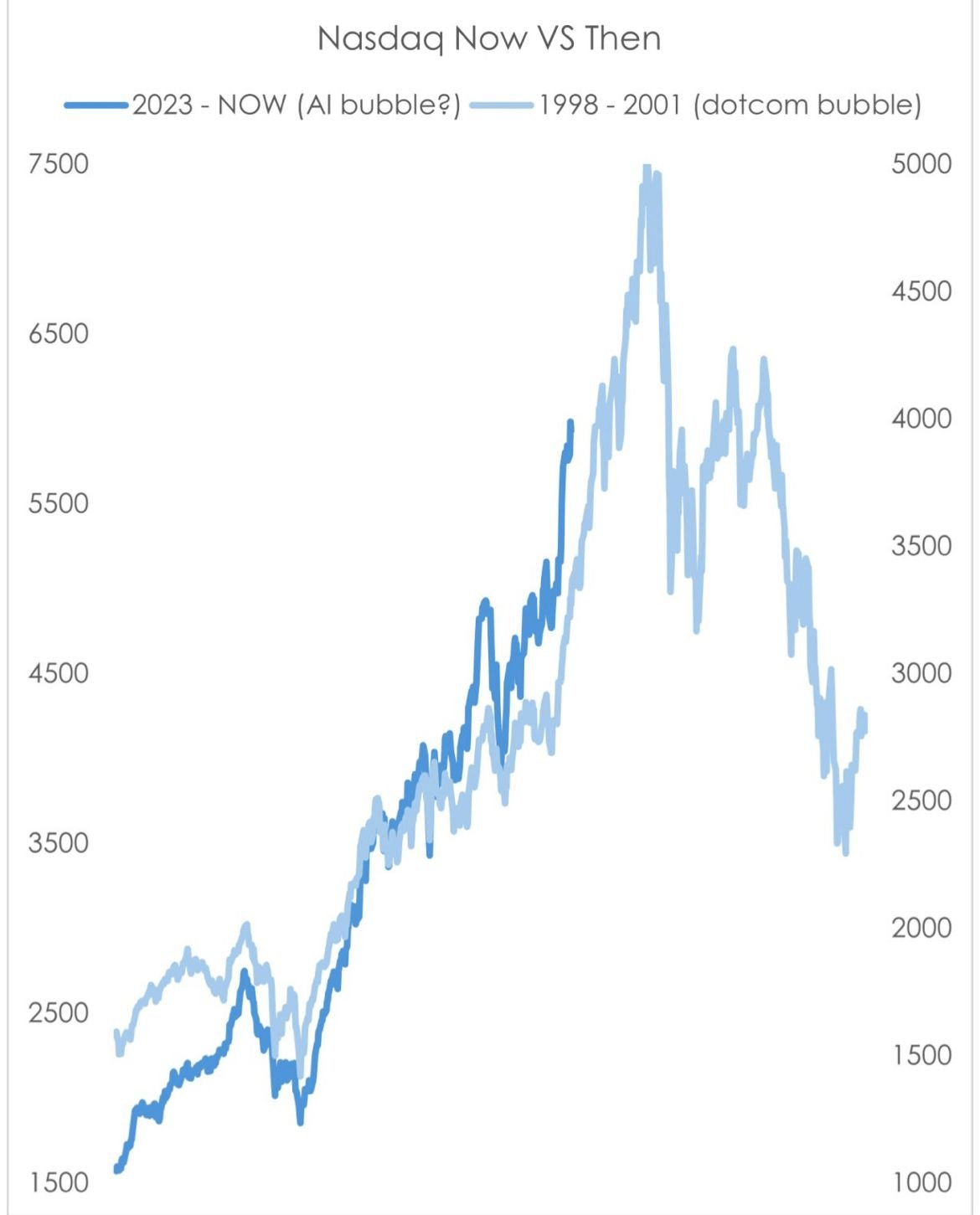

There has been a chart doing the rounds in a few of our investing chats and on Twitter (X). It draws a parallel between the Dot Com bubble of 2000 and the AI-fuelled stock market of today. And its implication is clear.

This highlights a trend we’ve been noticing recently. More and more mainstream media outlets seem to be asking questions about the stock market and the potential for an AI-fuelled bubble:

When the media starts talking like that, inevitably client questions follow. We’ve certainly seen an uptick in questions in the Equity Mates Facebook Discussion Group.

So we wanted to dig into the comparison between 2000 and 2025 to understand whether we’re seeing a stock market bubble emerge.

Our conclusion? While we’re certainly seeing more hype, three key data points give us confidence that today’s market is still a long way from 2000.

1. AI demand is real

The spending commitments of the large AI infrastructure players are unprecedented. In 2025 alone, Meta, Amazon, Alphabet and Microsoft plan to spend $320 billion. (CNBC) The size of these commitments naturally invites skepticism.

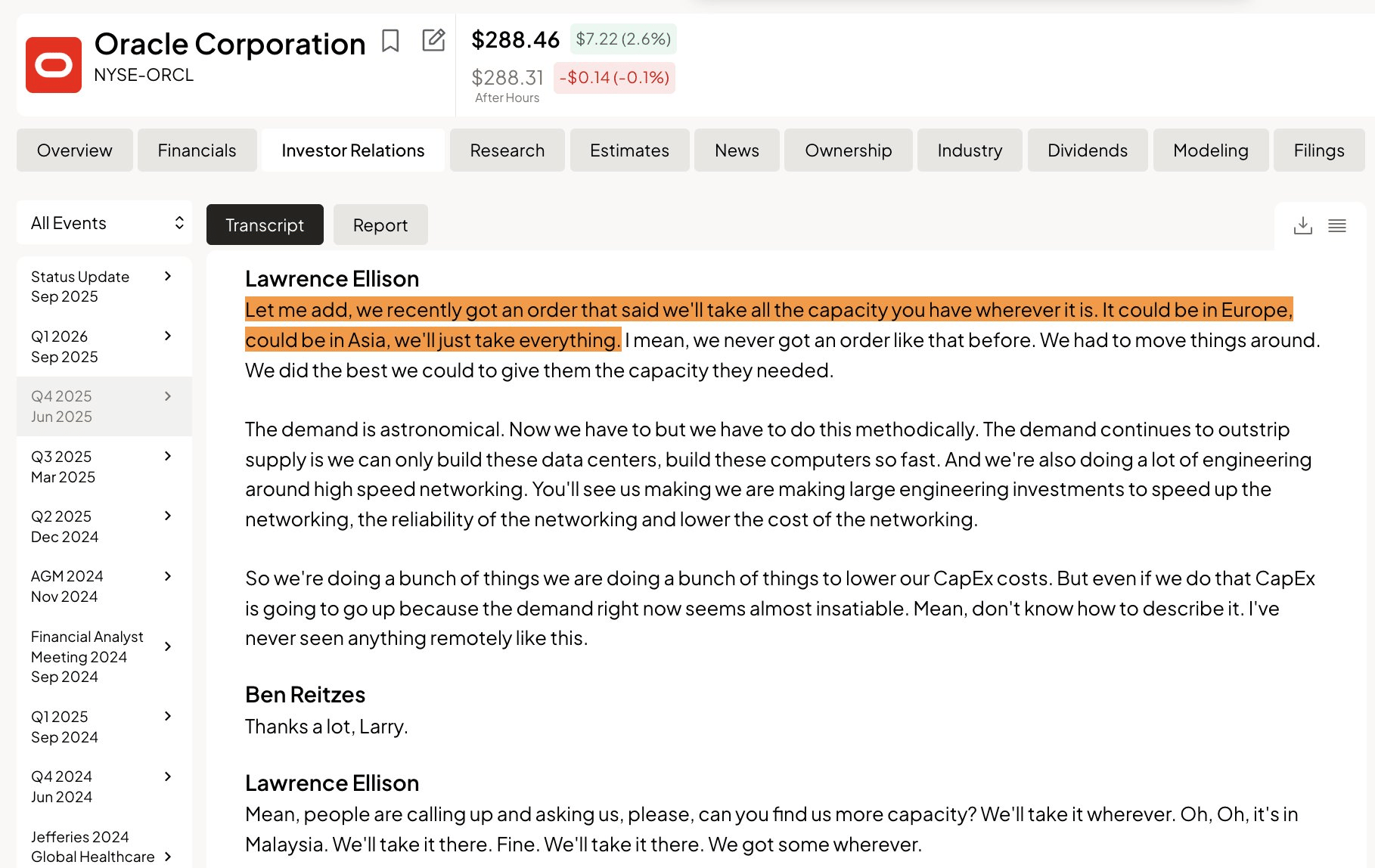

Yet, at least for now, these spending commitments appear to match the current level of demand. Recent comments from Oracle cofounder Larry Ellison’s sums up the race to secure any computing power:

This can be compared to the equivalent infrastructure boom of the 2000 Dot Com bubble: building out fibre-optic infrastructure.

We dug up a Forbes article from 2000 about these infrastructure investments. “Fiber-optic companies may not be growing at warp speed, but then again few industries can match their recent or near-term projected growth” (Forbes). In 2000, there wasn’t real revenues but projections for future revenue. This is different to the infrastructure story today, these data centre players are seeing real revenue growth.

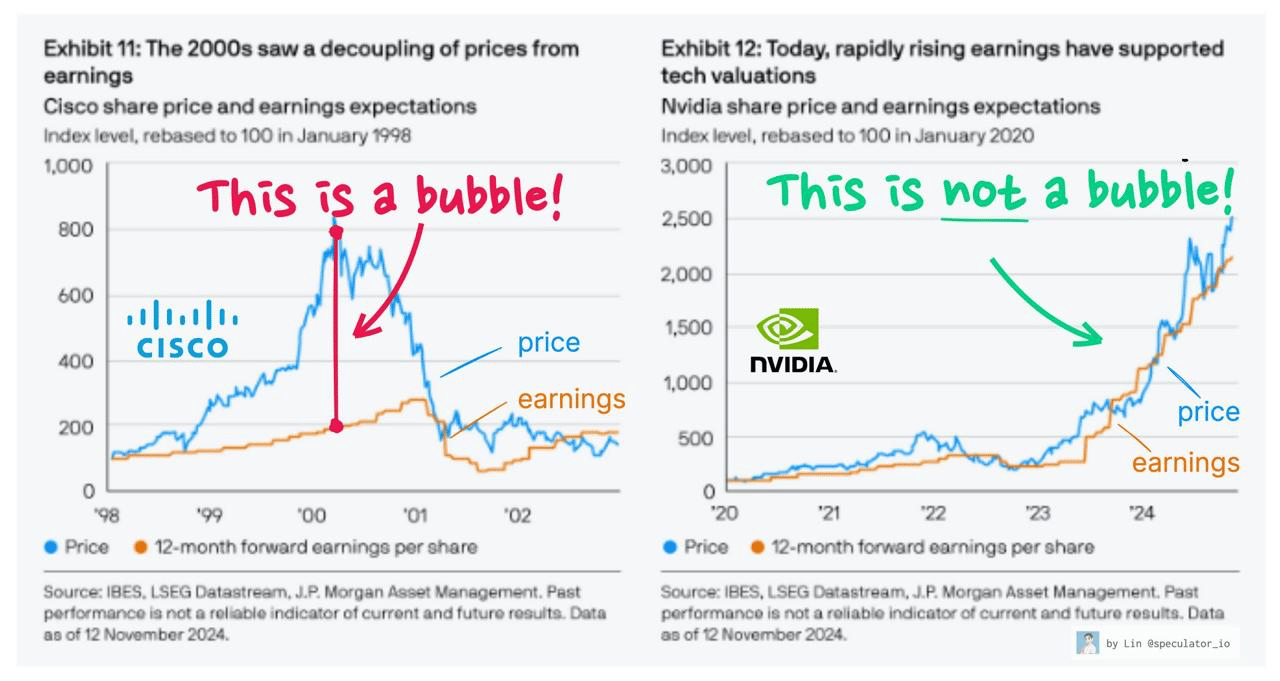

2. Market growth has been driven by fundamentals

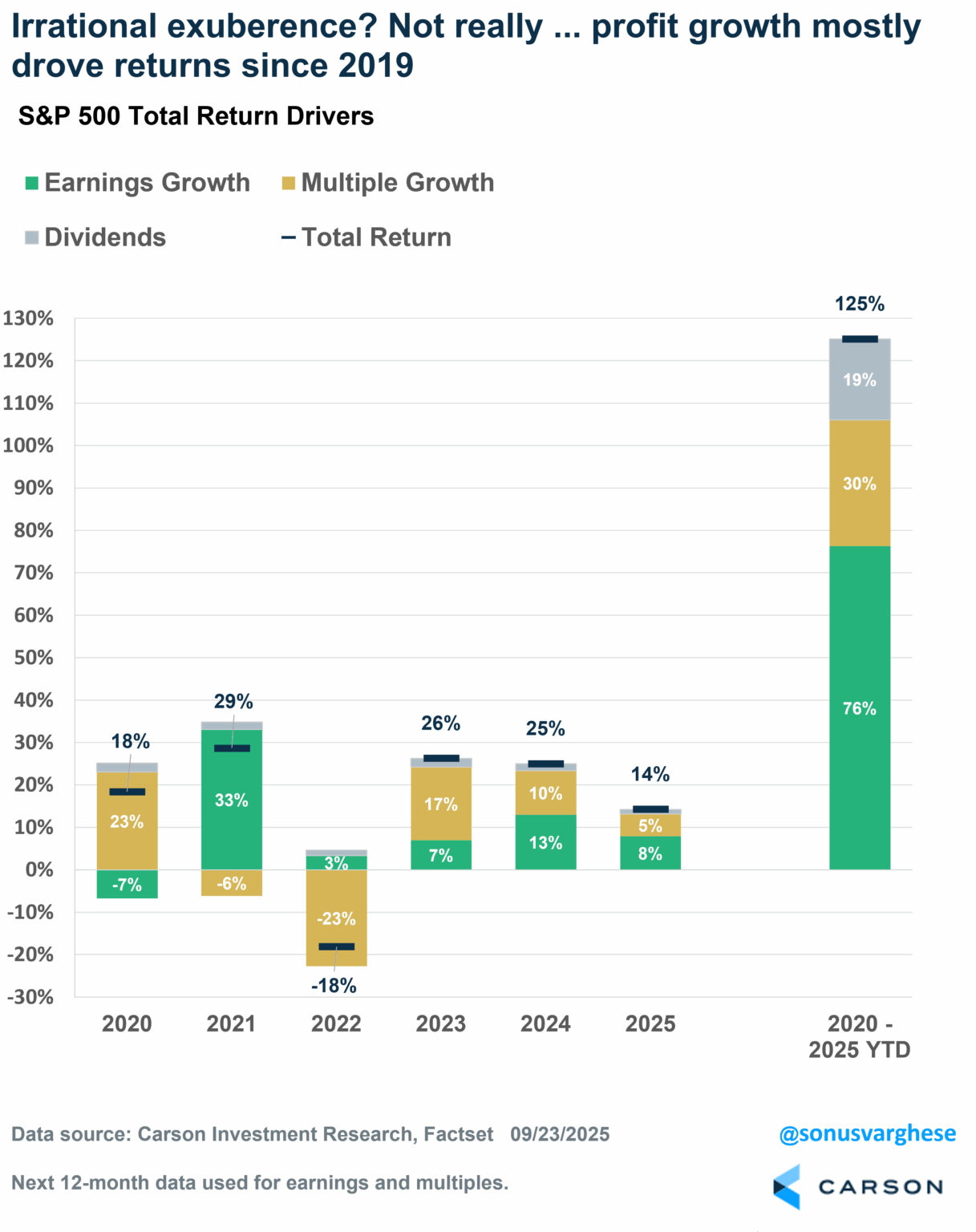

America’s S&P 500 has more than doubled since 2019, with dividends it is up 125%, and that rapid pace of growth has investors worried.

Sure, a stock market bubble is characterised by rapid share price growth. However, it is growth that is disconnected from the underlying economic reality. In a bubble, the multiples that investors are willing to pay for businesses expand.

Carson Investment Research looked at what has driven returns of the S&P 500 since 2019. More than three-quarters of the return have come from profit growth and dividends, with the remainder coming from multiple expansion.

3. Valuations don’t look stretched

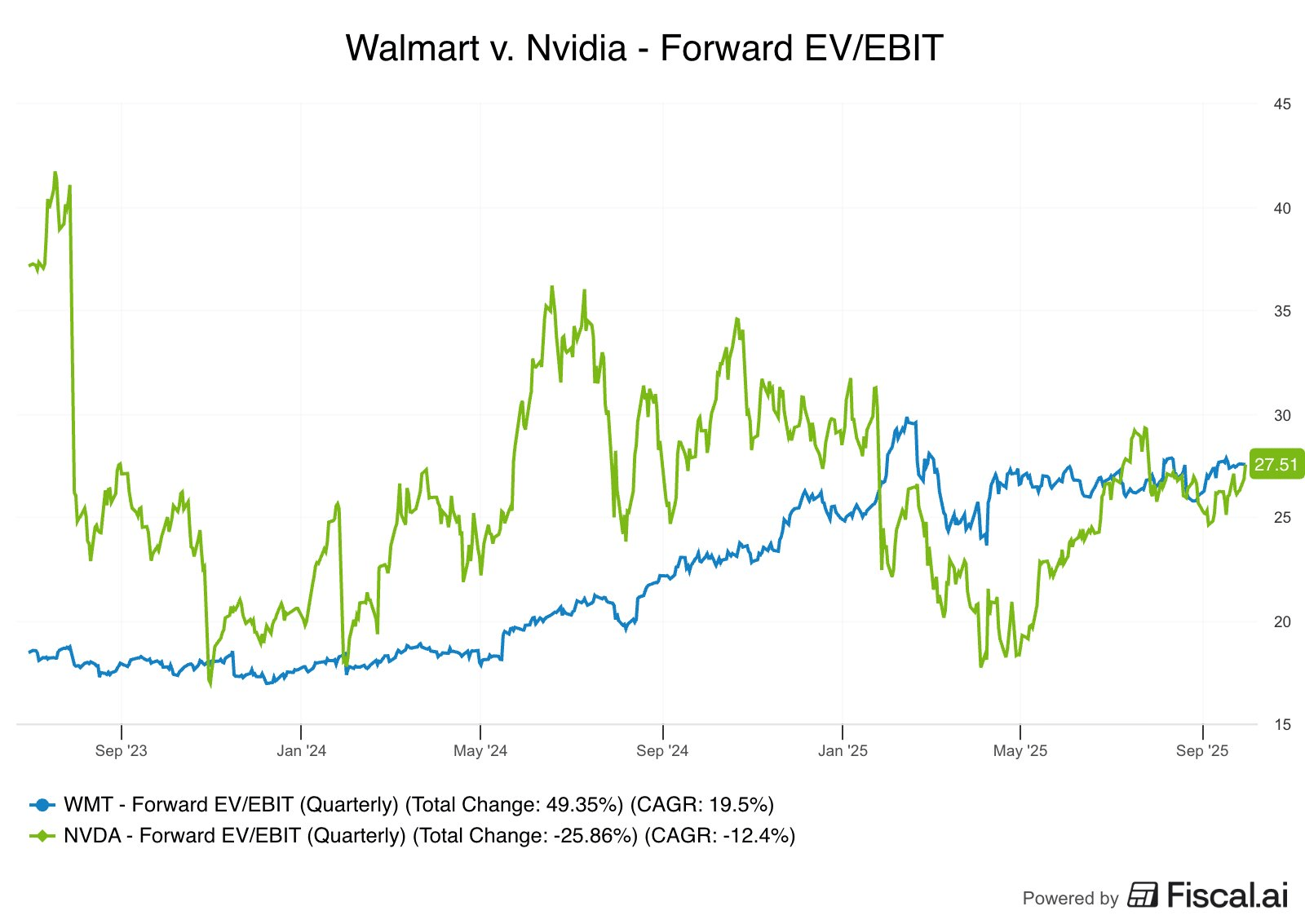

With the majority of stock market growth coming from earnings rather than expanding multiples, the valuations of many Big Tech stocks don’t appear outrageous.

In fact, when measured by a ratio of enterprise value-to-next year’s earnings (EV/EBIT) Nvidia and Walmart appear to be trading at similar valuations.

Look beyond the headlines: 2025 is not 2000

Financial media thrives on fear-mongering. The incentive is to get clicks, views and downloads and nothing gets those impressions faster than a reason to panic.

However, the underlying data tells the story: 2025 is not 2000.

The parallel is easy to see: two world-changing technologies that are generating a lot of hype. But, there is one key difference. The AI boom of today is generating real, profitable growth for the biggest players in the industry. Whereas the Dot Com boom saw plenty of users but not much profit.

So, at least for now, the stock market is not in a bubble. As this chart from J.P. Morgan neatly summarises.

With so many questions around the stock market hitting all-time highs, we’re sharing how we’re communicating with the young Australian investors in the Equity Mates community.

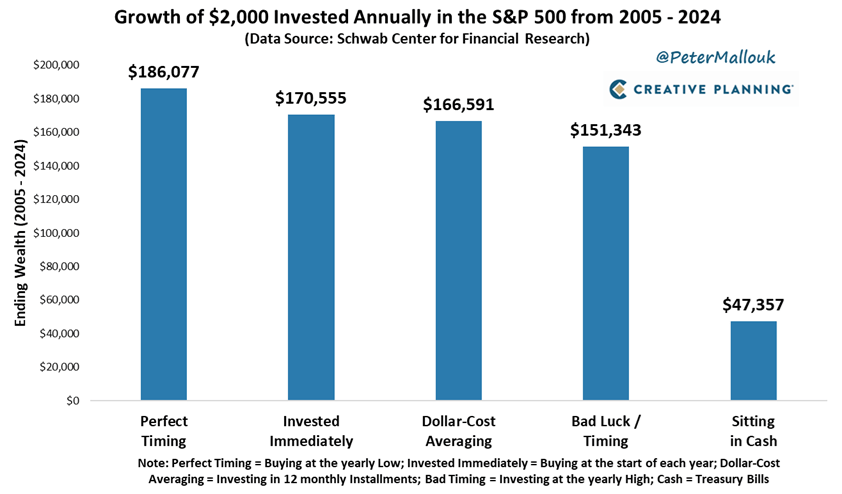

Remember the importance of staying invested

At a time like this, it is important to remind ourselves of the importance of staying invested. Timing the market is a fools game. You need to get it right twice: once when we sell and then a second time when we buy back in. And its hard enough to get it right once.

The Bank of America did a study that looked at S&P 500 returns from 1930 to 2024. In that time, the S&P 500 returned 17,715%. If investors had missed the best 10 days each decade, that return dropped to 28%. (CNBC)

Given that no-one can accurately predict the short-term movements of the market, it follows that no-one can accurately predict the market’s best days. So to ensure we don’t miss them, we must stay invested.

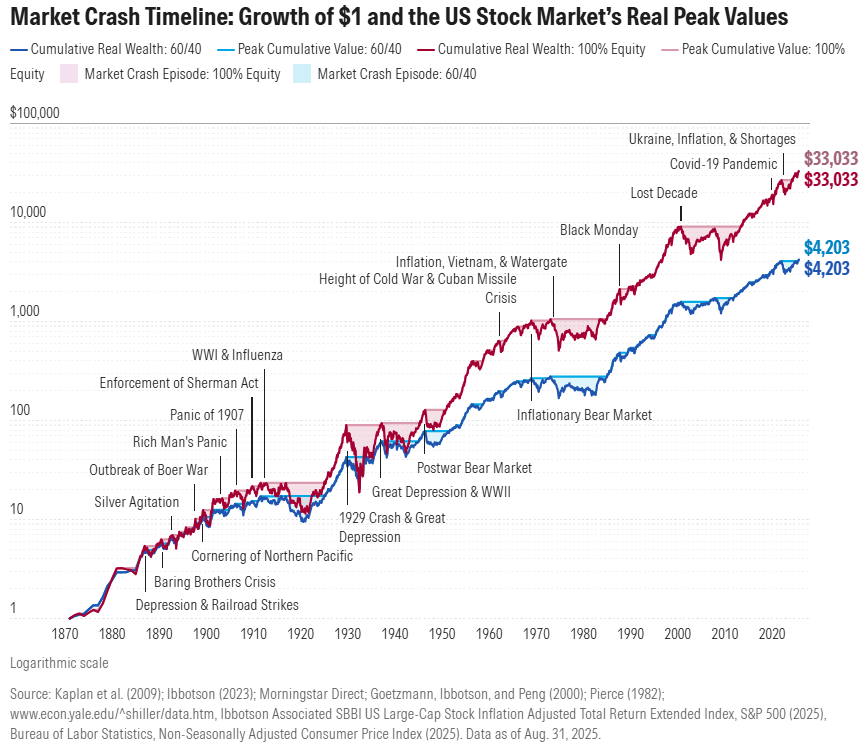

And history tells us that staying invested has been enough.

Over our investing lives, the stock market bubbles will look like small blips on the market’s slow, relentless grind upwards. The market continues to be driven by new companies, new technologies and teams of smart people finding new ways to grow their business. All we need to do is hang on for the ride and let them go to work.

What’s more, stock market history tells us that investing at the worst time is better than not investing at all.

So as you think about the stock market hitting all-time highs, always remember the following:

Financial media thrives on getting clicks and views, not helping you make good, long-term investing decisions

The stock market has climbed a wall of worry and will continue to do so, driven by new companies, new technologies and new ways of doing business

No-one can accurately time the market

Even investing at the worst time is better than not investing at all

Speaking of AI, it has certainly been a key topic in recent episodes of Basis Points. In our latest episode with Owen Raszkiewicz, founder of The Rask Group, we unpacked how AI is becoming a bigger part of the adviser’s toolkit.

Here’s a few select quotes from our conversation:

We use Google meets and all of our transcripts are automatically recorded. It runs through basically this kind of light version of an AI and it just parks it in our CRM for us as the file notes. So we don't have to do file notes. We do add our own from time to time if we correct it, but it's that innovation is rapid. So I'd encourage anyone to figure out how you can use that in a privacy sensitive manner.

Oftentimes the AI is not good at math, obviously it's not good at the sequence of things and it can be very noisy, but at the same time, it does a good job of getting people advice ready.

I would say that for the re-contribution strategies, for the transition to retirement strategies, all that stuff, AI is probably going to be here in the next year or two if it's not already just through the shelf tools.

Want to hear how Owen Raszkiewicz is working to build a modern advice practice? Listen on your preferred podcast app (Apple | Spotify) or watch on YouTube.