- Basis Points

- Posts

- Look beyond the Mag 7: There's plenty of ways to play AI

Look beyond the Mag 7: There's plenty of ways to play AI

Enjoy this email? Help us grow by forwarding it to another adviser that you think will enjoy it. The larger Basis Points gets, the better guests we can get on the show.

Want to help us make it better? Share your thoughts in our short survey and help us improve Basis Points for 2026 (Complete it here)

“What is the best way to invest in AI?”

It is the question that advisers, brokers, fund managers and anyone that works in finance is getting asked more and more. If one sign of a bubble is how often we get asked for stock tips - then I’d be starting to get a bit nervous about the state of this AI story.

But it is not just the requests for stock tips that have people asking questions. The well documented circular flow of money between the major US tech companies is raising questions about the sustainability of the revenue being reported. If OpenAI pays Nvidia, who pays Oracle, who pays OpenAI, they can all report revenue growth. Until someone stops paying.

AI bubble fears have become mainstream in financial media

So advisers are left with a challenge. Ensure client portfolios capture the upside of this AI story, while mitigating the risk if we see this circular flow of money slow down. We wanted to get our head around some alternative ways to approach this AI bull market.

So, how should an adviser play this moment? We asked Daniel Kelly, Chief Investment Officer of Viola Private Wealth.

It should first be pointed out that AI is not new. Google’s DeepMind made breakthroughs as early as 2010 in neural networks, specifically with the AlphaGo Zero program (google it, no pun intended), so this is more of a 15-year development journey rather than an overnight success story.

When investors are trying to gain an allocation to the sector, which we firmly believe they should, given the transformative and curvilinear path of development that is now exceeding Moore’s Law for the first time in human history, there are a number of ways to do this, and some are not as intuitive as they might seem. Whilst we are not of the view that the current rally is a broad-reaching bubble, there are some similarities with how investors should think about exposure that the dot-com boom and bust taught us, namely that it is very difficult to predict the individual winners at the application layer. In the race to AGI, we do not know whether it will be OpenAI, Grok, Google or Anthropic that is the model that comes out on top, so it is also difficult to know which of the MAG7 will be the ultimate winner in the race to digital superintelligence.

The more likely answer is that it is not one winner and that AI is going to benefit the economics of every business model in the world, even businesses that are not directly involved in its development, in a similar way to how almost every business on the planet is now a beneficiary of the internet. I, for one, can vouch that Viola Private Wealth has significantly benefited from our use of artificial intelligence, which has helped us save costs, drive more revenue and deliver better outcomes for our clients, even though we are not an AI company. The same thing is happening to business models all around the world which is why we argue the market deserves a higher PE ratio that is has historically commanded.

For this reason, we would steer clients and investors towards simply buying and holding the Nasdaq 100 to ensure they participate in the aggregate growth of the technology and avoid idiosyncratic company risk, given the speed and pace at which disruption is occurring. Almost every company on the Nasdaq is going to be a beneficiary of the efficiency gains and revenue growth AI can inject into a business, and if it is possible that AGI (digital superintelligence) is created by a single company in a ‘one ring to rule them all type of future’, you can rest assured that it is almost certain to occur or list on the Nasdaq at some point in time, so a strategic allocation to the high-growth index almost ensures participation in the wave whilst also avoiding the losers that come with any great technological revolution.

To those that have access and the ability to invest in private markets, we also believe that a significant amount of this technology disruption and innovation will start in the VC market and also stay private for longer, so combining a well-considered venture capital allocation to AI / deep tech, combined with a listed allocation to the Nasdaq 100, is our preferred way to ensure we catch the wave and avoid the wipeouts.

As we discussed AI opportunities outside of the Magnificent 7, the conversation turned to opportunities here in Australia. Some have been well discussed - e.g. Goodman Group building data centres or NextDC operating them - but it turns out Australia is in prime position to benefit from another emerging AI winner.

Over the past 6 months, copper has emerged as a big winner of the AI story. As hundreds of billions of dollars is committed to build new data centres, questions have emerged about their energy needs. Critical to build this new electrical infrastructure is copper.

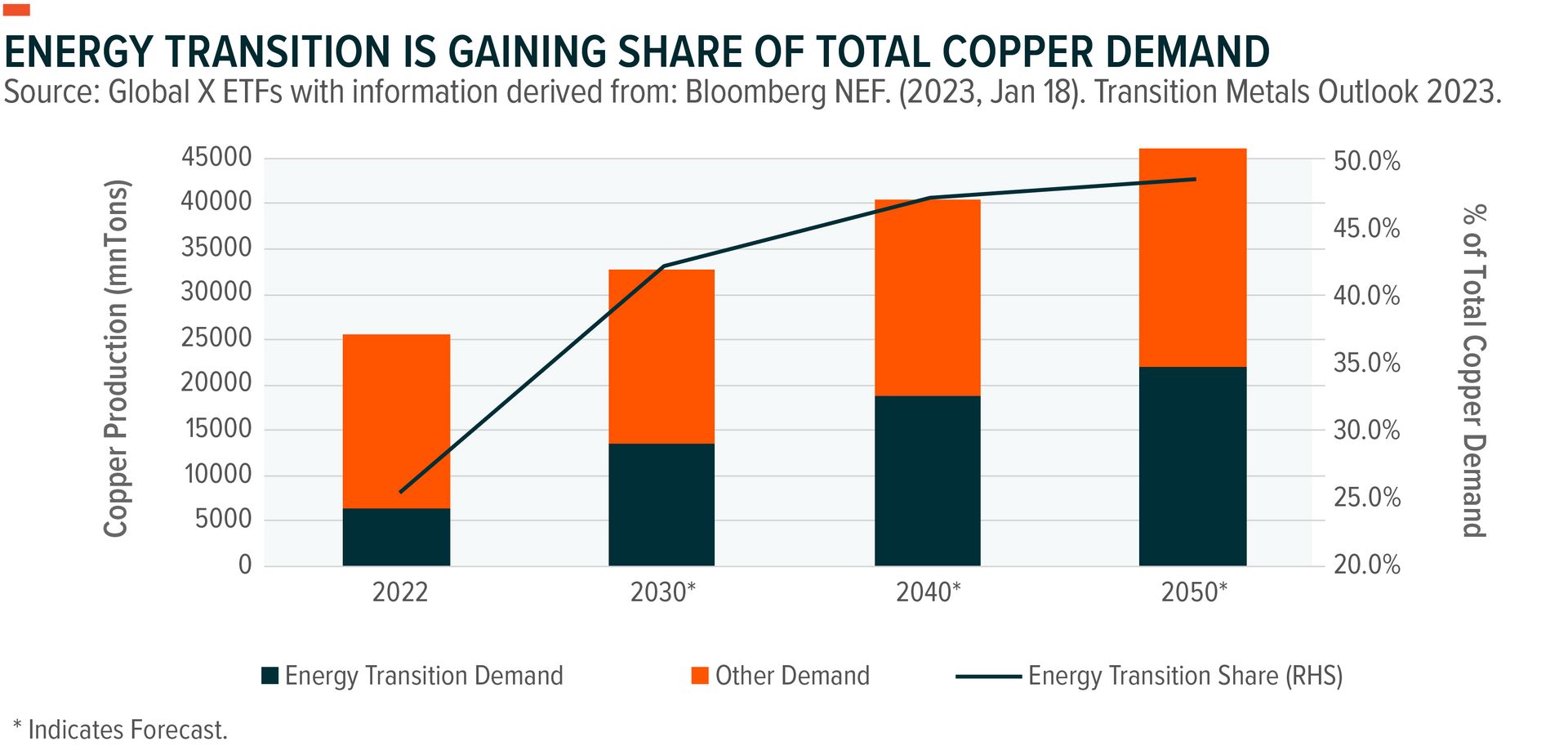

Copper was already forecast to be in a structural deficit for the next 10 years due to the huge demand from renewable energy infrastructure. This AI data centre boom has just blown those estimates out even further.

And here’s the best part, for Australians at least. Much like iron ore, nickel, lithium, rare earths, and so many other metals central to the world economy: Australia is blessed with copper.

An investing opportunity that is exposed to the AI story, will benefit from huge investments in renewable energy, and plays into Australian’s love of mining? Tell us more.

There wasn’t going to be enough copper even before AI. The expected demands for copper from the electrification of future technologies was already going to overwhelm supply, long before the AI revolution kicked off when ChatGPT became mainstream.

Now, the demand for copper is entering an entirely new level – and the market doesn’t seem to have caught on, at least if you look at the copper chart.

Australia’s edge in copper

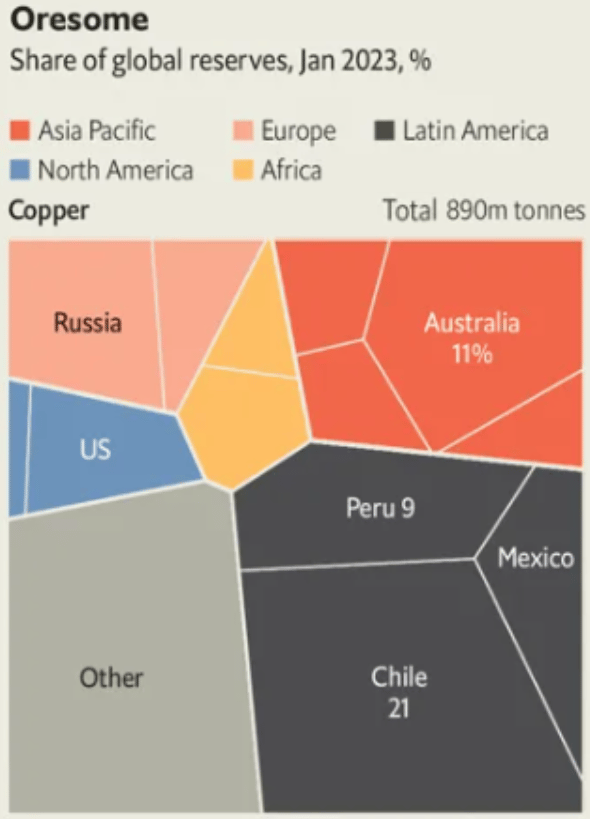

Currently the majority of the world’s copper comes from South America. Chile and Peru export 29% and 20% of the world’s supply, respectively (WTP). Australia hovers around fifth for copper exports globally.

However, when it comes to reserves, Australia has the second most on earth:

Source: USGS/The Economist

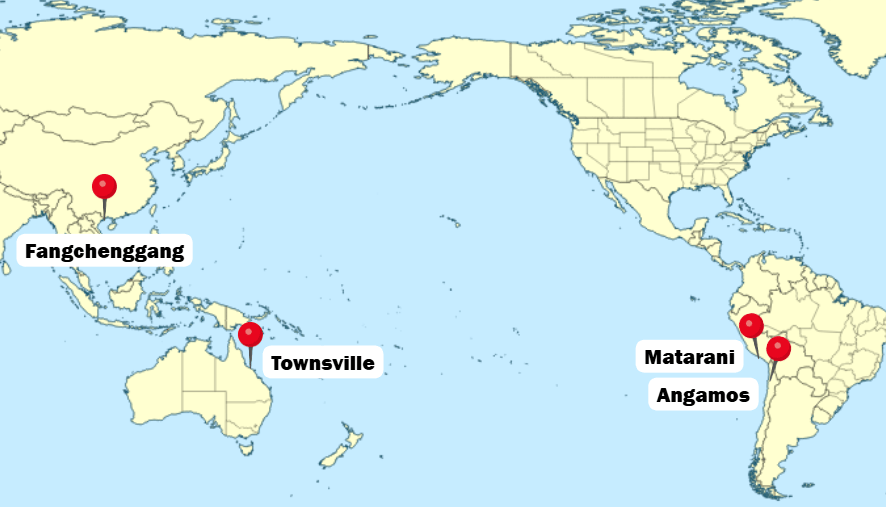

Australia also has a structural advantage in the copper trade. China imports between 60% and 65% of the world’s copper. Chile and Peru are more than 20,000km away, more than three times the distance of Australia’s major copper port, just 7,300km away.

Copper is already in a structural deficit

Even before ChatGPT launched in 2022, forecasts of copper’s future demand saw a huge step up. This is because demand for the metal is tied to large megatrends such as rewiring the electricity grid, renewable energy and urbanisation.

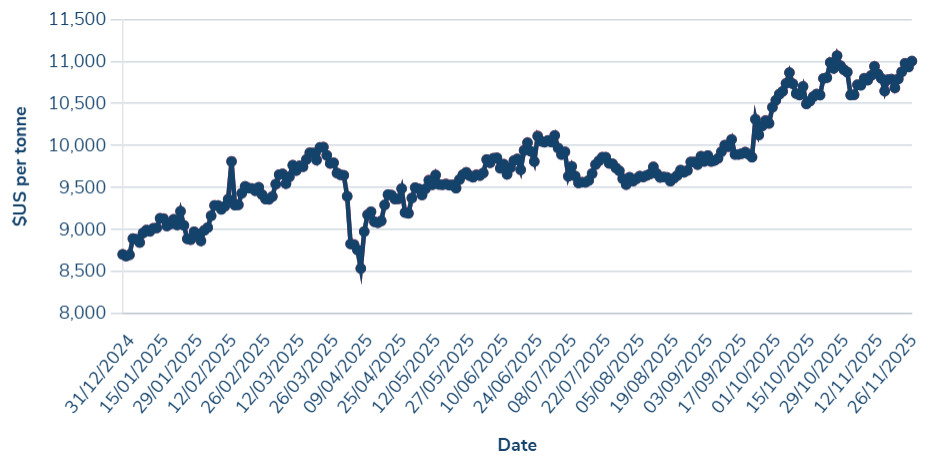

As demand increases, supply is pinched. Mine disruptions in top producing countries have driven up copper futures on the London Metals Exchange by 26% so far in 2025:

Source: London Metals Exchange

This trend is expected to continue. Last week, UBS estimated a 2026 copper supply deficit of 407,000 tonnes on the basis of mine disruptions continuing in Indonesia, Chile and Peru. As a result, UBS goes on to forecast copper prices reaching US$13,000 per tonne by the end of 2026, a 16% increase from the current US$11,200 (Mining Weekly/UBS, LME).

Now AI is supercharging demand

Now add in AI. The growing demand from data centres has exacerbated this forecast supply-demand mismatch. Throughout the AI value chain, copper is the metal that holds it all together. Copper’s conductivity and corrosion resistance makes it ideal for AI chip production. Zoom out to the data centre themselves; copper’s thermal properties make it the safest and most space-efficient option in tightly-packed data centres. Zoom out again; the vast electrical infrastructure that powers data centres is largely copper.

Microsoft’s US$500 million data centre in Chicago used 2,177 tonnes of copper (BHP). Bloomberg forecasts that AI facilities will require an average of 400,000 tonnes of copper per year for the next decade.

What if the AI bubble bursts?

While the macro set up for copper looks positive, it is always important to remember that commodities are cyclical and prices can turn quickly. Plenty of Australian investors learned that the hard way when the lithium price turned in late-2022.

The good news is, if the AI boom ends, copper demand is firmly rooted in more traditional sectors. Construction, electronics, and transportation are the top three consumers of copper in the US and presumably in most developed countries (USGS).

Increased electrification in both developing and developed countries will continue to be the biggest driver of demand. In developed countries, increased proliferation of electric vehicles and renewable energy drives up the demand for copper, as both are significantly more copper-intensive than traditional vehicles and power generation.

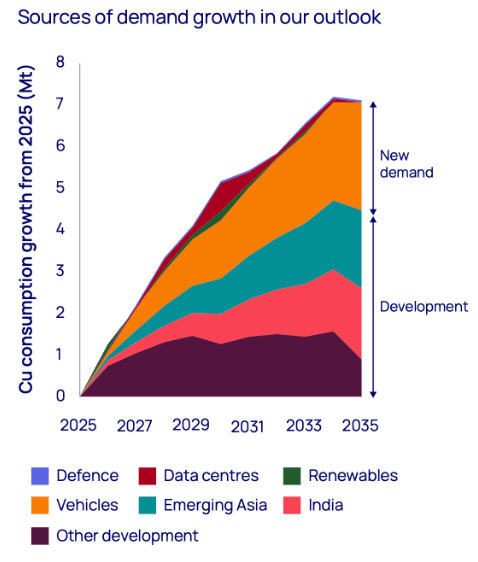

The larger driver of new copper demand is in developing economies, namely India and Southeast Asia. India, Indonesia, the Philippines, Vietnam, and other Southeast Asian countries account for over 2 trillion people, and these countries are experiencing rapid industrialisation and electrification. If these countries industrialise at even 50% of the rate of China, they will require an additional 5.4 million tonnes of copper annually (Wood Mackenzie).

Source: Wood Mackenzie

Where is the investing opportunities in Australia?

With the world’s second largest copper reserves there is plenty of scope for expansion of Australian’s production. The federal government is leaning in to the copper opportunity, and has recently supported two major copper projects with over $2.5 billion.

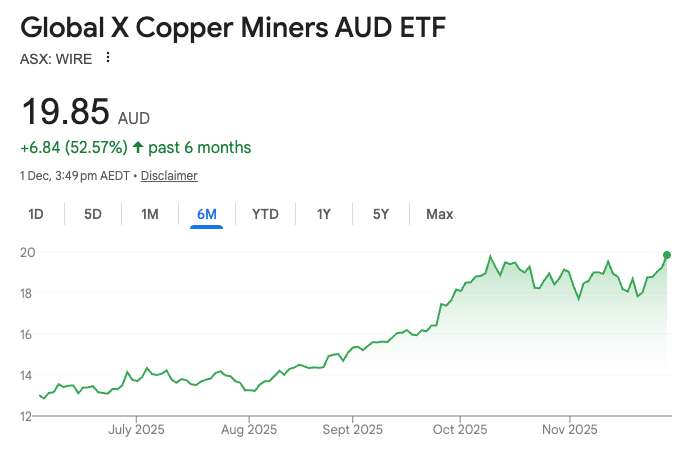

Traditionally, finding copper opportunities on the ASX has been difficult. But there are three ASX-listed pure-play and diversified companies that can give investors good exposure to Australian copper. The ASX-listed Global Copper Miners ETF also provides exposure to copper but not specifically to Australian copper.

Company | Type | Market cap | Performance (1Y) |

|---|---|---|---|

Sandfire Resources (SFR) | Pure-play | $7.2 billion | + 49.7% |

Aeris Resources (AIS) | Copper-focused | $0.6 billion | + 175.0% |

BHP Group (BHP) | Diversified | $212.6 billion | +3.0% |

Global X Copper Miners ETF (WIRE) | Pure-play | $0.4 billion | + 48.7% |

With the Copper Miners ETF up more than 50% in the past 6 months, we should expect to be hearing a lot more about copper in 2026.

Basis Points is supported by Milford

We are pleased to announce Milford’s two new actively-managed funds.

Milford’s Corporate Bond Plus Fund and Australian Active 100 Fund have been created in response to growing adviser demand for more liquid, transparent credit solutions.

Managed by Portfolio Manager Anthony Ip and Deputy Chief Investment Officer Paul Morris, the Corporate Bond Plus Fund invests primarily in publicly traded Australian investment grade corporate, government, and semi-government securities.

The Australian Active 100 Fund is managed by Portfolio Managers Jason Kururangi and Roland Houghton. It is a high conviction domestic equity fund, designed to tackle the concentration trap in many Australian equity offerings.

Both are now available at a $1000 minimum investment.

Looking for way to scale your financial advice business and provide advice to more clients?

We sat down with Jeff Thurecht and Marshall Brentnall, CEO and CIO at Evalesco Financial Services, to talk about how to balance scaling the business while keeping advice personal.

We also discussed the importance of identifying your target audience, as well as how to build portfolios that meet their needs.

Listen to our conversation with Jeff and Marshall in our latest episode of Basis Points (Apple | Spotify | YouTube)