- Basis Points

- Posts

- More volatile than Bitcoin: An adviser's take on gold & silver

More volatile than Bitcoin: An adviser's take on gold & silver

200 advisers. Sydney Harbour. One afternoon you won't forget!

Join us on The Island for the inaugural Basis Points Boat Party - featuring Charlie Viola on his first year building Viola Private Wealth, rapid-fire pitches from leading fund managers, and plenty of time to connect over drinks.

Tickets are complimentary to the Basis Points community – use code BPBP_TIX at checkout.

Spots are limited and exclusive to advisers. Please ensure you can commit to the afternoon before securing your spot.

What is happening with gold and silver? Precious metals have been the talk of the investing world to start 2026. In today’s Basis Points email we look at how Australian investors have responded and how one adviser is approaching this moment.

“Thirty-day volatility in gold has climbed above 44%, the highest since the 2008 financial crisis, overtaking Bitcoin's (BTC-USD) roughly 39%, according to Bloomberg data.”

So much for a safe-haven asset. Gold and silver are behaving more like meme stocks than long-term stores of value.

There have been plenty of rational reasons to increase allocations to precious metals over the year - fears of currency debasement, sticky inflation and the prospect of a politicised Fed Chair that will listen to President Trump’s call for aggressive rate cuts. But the flight to safety en masse has created an irrational market.

Silver doubled in 2025 while gold was up 50%. Then January saw an even sharper move higher for the precious metals. Gold was up slightly more than 20% in a month then dropped 11% in day. Silver was up 56% in a month and then dropped almost 30% in a day. To put it in perspective, silver’s drop was larger than Bitcoin that dropped 11% between the 29th and 31st of January. So much for a safe haven asset.

In the past 13 months, precious has demonstrated characteristics that make it look more like a meme stock and less like a long-term inflation hedge.

Retail interest: Google Trend volume since 1 January 2025 tells the story. Searches for ’Silver Price’ are up 120%; ‘Gold Price’ is up 130%.

Volatility: In the past 12 months, there were 23 days that saw the price of silver futures move by more than 5%; 10 of these are in 2026.

Option volume: There were an average of 380,000 options traded daily on iShares Silver Trust “SLV” in January 2025. That number has increased by nearly seven times, with an average of 2.6 million SLV options traded daily in January 2026.

Given there is so much retail interest in the precious metals, we went and surveyed over 1,500 everyday Australian investors to ask them how they’re thinking about investing in gold and silver.

This doesn’t come as a surprise. Since the start of 2026, the AFR has published no less than 21 articles on the prices of gold and silver and pictures of lines outside ABC Bullion have been doing the rounds. Of course investors are hearing more about precious metals. But, are they buying?

It turns out, no. 35% of respondents had invested in precious metals before this year. Only 40% have or plan to invest this year. A surprisingly small uptick.

How are Aussie investors getting exposure?

For the 40% of respondents that are looking to buy gold or silver, we wanted to know how. In response to an open-ended question - “If you plan to invest, how do you plan to invest?” - 63% plan to invest through ETFs, with PMGold being the most common suggestion. Despite the long lines outside of ABC Bullion, only 9% said they would invest in physical gold or silver.

What do investor still want to know?

Perhaps most relevant for advisers is to understand the questions investors still have about gold and silver. Unsurprisingly, the most common questions were “Is it too late?” and “When will it peak?” which made up about a third of responses. There were also plenty of “Which will do better in 2026 - gold or silver?”. If anyone knows the answer to these questions - please let us know.

Another common theme was “Is it all just hype?” and “What is behind this?”. What was clear from these questions is that investors are looking to understand the story behind the volatility. It suggests that there is demand from Australian investors for well-research, considered commentary to explain this moment.

To help us understand this precious metals story, we asked Luke Laretive to share his thoughts. Luke is the CEO of Senaca Financial Solutions and manages the Seneca Australian Shares & Seneca Australian Small Companies Fund, which generated 17% & 34% respectively in 2025, with strong exposure to resources.

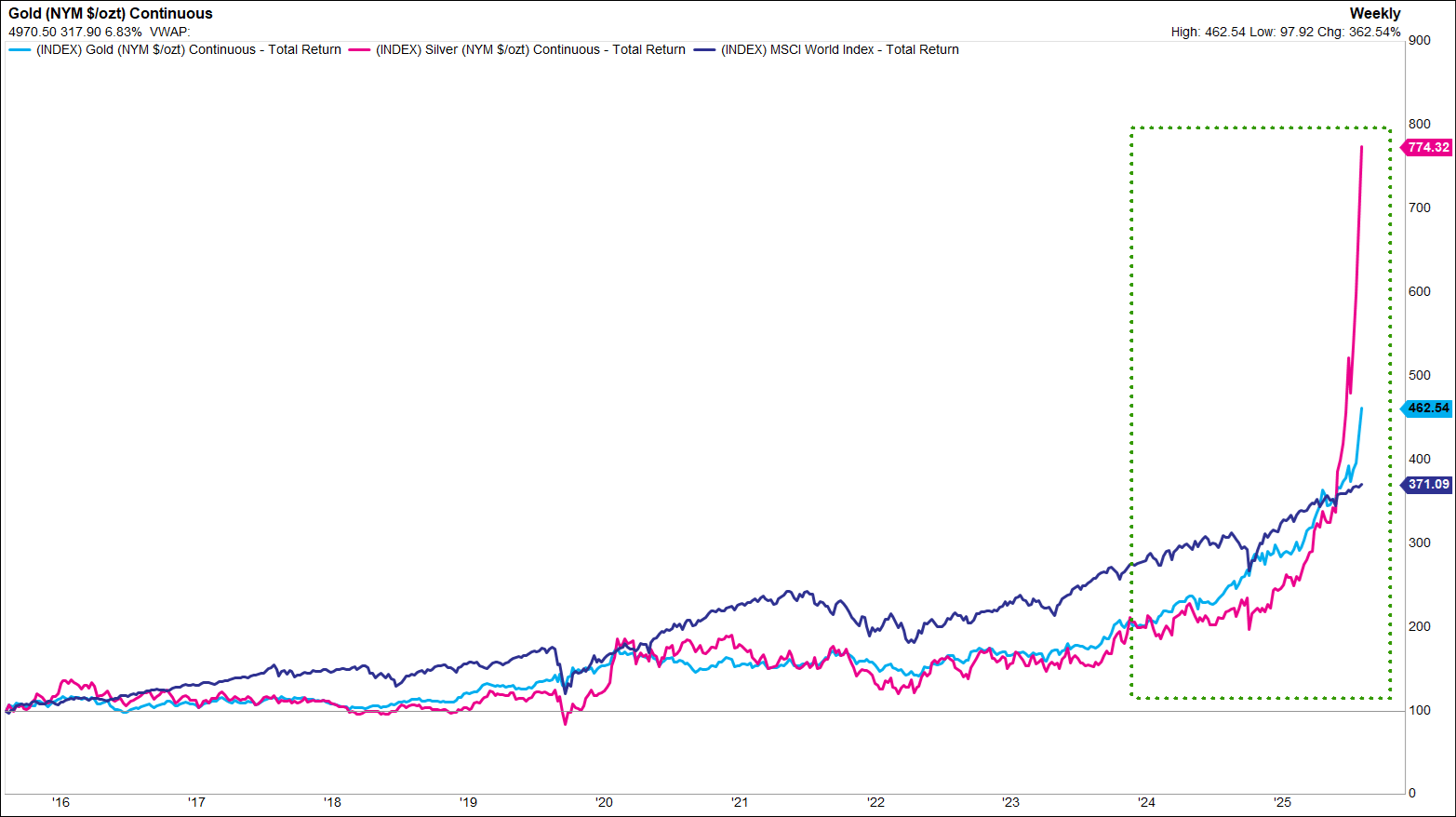

Gold and silver have been front-page news in recent weeks, with both making record new highs to 29 Jan.

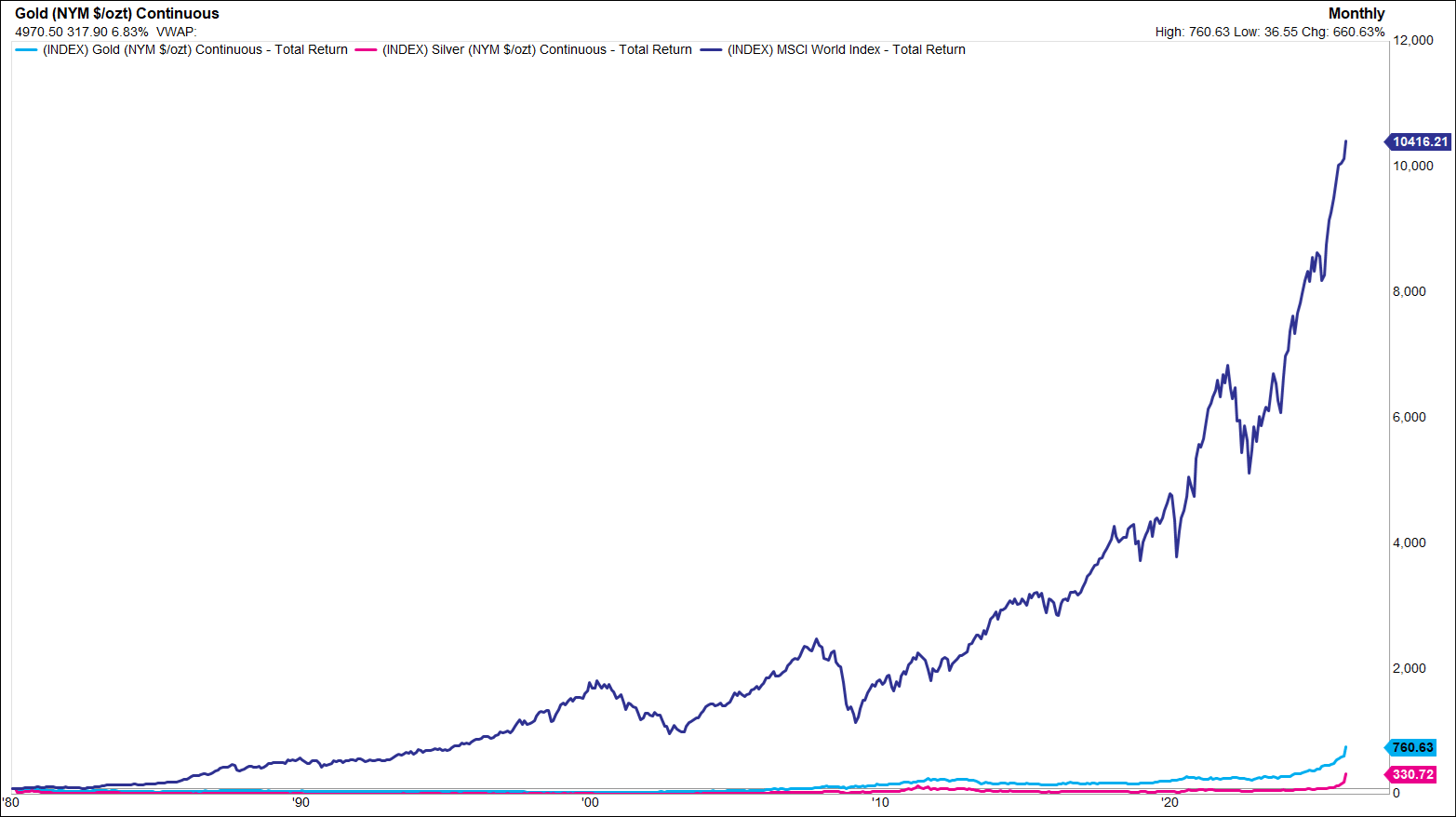

Source: FactSet, Seneca Financial Solutions

This momentum stalled on 30 January. Silver prices have fallen 34% and gold is down 16% - what happened? Is this an opportunity to buy the dip? Some context might help us decipher signal from noise.

From 1980 to the end of 2023, gold and silver delivered modest returns, ~6% p.a and significantly underperforming the global sharemarket (10.80% p.a. over the same period.)

Source: FactSet, Seneca Financial Solutions

However, it’s been the last 2 years performance that makes hindsight 10-year compounding returns look so attractive, relative to shares.

Source: FactSet, Seneca Financial Solutions

While this might seem exceptional, some basic statistical analysis exposes the truth -this sort of volatility is typical for precious metals markets. Investors experience relatively short-lived, exceptional periods of returns, interspersed with long periods of modest, inflation-plus type returns.

Source: FactSet, Seneca Financial Solutions

Forecasting commodity prices is, in our view, so difficult it’s almost pointless. Precious metals are particularly challenging, with demand drivers tied to the aggregate appetite to store wealth, (inflation, government fiscal/monetary policy and/or general risk-off sentiment). Contrast this with industrial commodities (used to produce goods) that have more stable, predictable and slow-moving demand drivers (i.e. how much steel the world needs next year.)

Like currency pairs, there’s some useful rules of thumb to help guide your thinking. However, our level of conviction in these concepts is always 51%/49% - it helps you understand but not necessarily forecast.

Gold has no yield, so its opportunity cost is best measured by real (inflation-adjusted) interest rates i.e. US TIPS. Falling TIPS = rising gold price.

Gold is priced globally in USD. A stronger US dollar makes gold more expensive for non-US buyers. Rising USD = falling gold price. This is what happened on 30 January.

Source: FactSet, Seneca Financial Solutions

Unlike gold, silver has both speculative (store of wealth) and industrial applications. There has been much written about silver’s use in solar panels, EV chargers and nuclear reactor rods (including by me in May 2024, link here.)

From a store-of-wealth perspective, gold looks about as cheap, relative to silver, as any time in the last 20 years.

Source: FactSet, Seneca Financial Solutions

Bulls will argue this is structurally supported by a lack of supply (it’s typically a by-product of copper, lead or zinc mining – all of which, until recently, have been in neutral/bear market conditions) and the aforementioned electrification trends.

Moderates (like me) will point to periods in history when silver has outperformed gold, arguing that silver is pro-cyclical and aligns with an accelerating business cycle. This is marked by strong PMI’s, reflation conditions and liquidity expanding (… sounds like 2026 to me.)

An Adviser’s Perspective

Asset allocators have a handful of critical decisions to make on behalf of their clients when it comes to advising them about commodities and precious metals. While overall exposure levels should most likely be driven by personal circumstances, we think all Australians can benefit from investing in our nation’s rich endowment of mineral reserves, world-leading skilled labour force, strong safety and environmental regulations, stable regulatory environment and high standards of corporate governance.

Our view is that the data (and intuition) is supportive of employing an active manager. From my quick analysis of some active natural resources managers this week, they’ve been able to achieve average annual outperformance of 3%.

Source: FEAnalytics, 2 Feb 2026

Intuitively (and from experience), resources investing is tricky. It requires some specialist knowledge and experience. We think this intuition is supported by the data as well, in the divergence of returns across the active manager landscape in any given year.

Like with the underlying commodity prices, it’s important to be aware of recency bias and the impact of the exceptional 24-month period we’ve experienced in precious metals, on long-term compounding returns. Below we highlight the same sample group, but with annualized returns from 2021 to 2024 – before the recent bull market. Returns and outperformance have been more modest.

Source: FEAnalytics, 2 Feb 2026

As an asset allocator, unless you feel confident in timing your allocations to/from resources-specialist funds, we’d suggest that a generalist active manager with resources and industrials capability might serve your clients better, over the long run.

Where to from here

In the Seneca Australian Shares and Seneca Australian Small Companies Fund we are reducing our exposure to gold, a counter-cyclical commodity in favour of pro-cyclical commodities (base metals, energy and to a lesser extent, iron ore/met coal.)

We still own some gold and silver companies. Our process is not driven by macroeconomics or views on commodity prices and we continue to see stock-specific value across almost every corner of the Australian share market - gold and silver included.

Resultant from large inflows into passive, index-tracking ETF’s, we continue to see the best value in the smaller, lesser-known parts of the market - small cap resources have dramatically outperformed large cap resources over the past 25 months. In the longer-term, they still have plenty of catching up to do...

Source: FactSet, Seneca Financial Solutions

Basis Points is supported by

Are your clients’ portfolios genuinely diversified?

Many investors remain highly concentrated in last decade’s winners and expensive growth stocks, and we see scope for potential pain unless investors adjust their portfolios. If investors hold multiple active funds to achieve diversification, but those active funds invest in very similar things, investors can end up being diversified in name only. Blending contrarian style and value stocks into a passive and growth equity portfolio can improve diversification. Less than 10% of the Orbis Global Equity Fund (by weight) overlaps the World Index – its value-oriented, contrarian approach presents a genuine diversification opportunity and could be the missing piece in your clients’ portfolios.

For advisers and wholesale investors only. Equity Trustees Limited ABN 46 004 031 298 AFSL 240975 is the Responsible Entity for the Global Equity Fund. This is general information only. Read the PDS, TMD and full disclaimer at www.orbis.com.