- Basis Points

- Posts

- Predictions Consolidated: What financial institutions are forecasting for 2026

Predictions Consolidated: What financial institutions are forecasting for 2026

Enjoy this email? Help us grow by forwarding it to another adviser that you think will enjoy it. The larger Basis Points gets, the better guests we can get on the show.

“What are the top financial institutions predicting for 2026?”

Every year, major investment banks, asset managers, and financial media outlets publish their predictions for the year ahead, ranging from comprehensive annual reports to shorter, targeted forecasts in news articles and commentary.

We’ve combed through predictions from some of the most reputable financial institutions and synthesised the key takeaways to help inform you for the year to come.

To keep the predictions relevant to financial advisers, we’ve consolidated the predictions into seven categories: Australian equities, global markets, central banks and interest rates, Australian property, alternatives, AI, and a surprising theme. We’ve also included adviser-specific takeaways for each category.

Australian Equities

The ASX is expected to produce decent returns in 2026, but high valuations, stagnant earnings, and concerns around concentration risk are expected to dampen the market. The ASX 200 forecasts differ between publications, but average around the 5% mark:

Source | Prediction | Growth |

|---|---|---|

8,900 | 2.0% | |

8,900 | 2.0% | |

9,250 | 6.0% | |

9,375 | 7.4% | |

9,400 | 7.7% |

Structural demand and commodity price resilience are expected to underpin the materials sector as a potential outperformer, with UBS, IG, and Morgan Stanley all picking materials to be the leader of the ASX for 2026. Materials make up only 19% of the ASX 200 in terms of market capitalisation, but contribute 28% of its earnings, leaving room for valuation upside.

Financials will remain dependent on RBA rate decisions. Rate cuts in 2025 drove strong returns from the banks but left them with elevated valuations, with the average PE ratio of the bank sector now hovering around 19 times. Morgan Stanley puts it plainly: “We do expect the banks to underperform the broader market.”

Adviser takeaways:

The broad consensus among analysts is that the materials sector is currently trading at an attractive valuation and will benefit from resilient commodity prices.

The financials sector, namely banks, may suffer a pullback at the hands of RBA rate decisions and valuation skepticism.

Global Markets

Financial institutions are expecting the S&P 500 to have another strong year driven by continued earnings growth from the Magnificent 7. Forbes consolidated several predictions:

Source | Prediction | Growth |

|---|---|---|

Bank of America | 7,100 | 3.5% |

Societe Generale | 7,300 | 6.4% |

JP Morgan | 7,500 | 9.4% |

Goldman Sachs | 7,600 | 10.8% |

Morgan Stanley | 7,800 | 13.7% |

Capital Economics | 8,000 | 16.6% |

Oppenheimer | 8,100 | 18.1% |

Fidelity and Allianz both point to AI-related market concentration and stretched valuations as causes for concern, with T Rowe Price additionally adding that soaring capex and debt finance will need to be supported by clear AI monetisation strategies.

Enter the Europeans. Fidelity recommends looking to international stocks, and State Street highlights Germany’s €500 billion joint defence-infrastructure fiscal package as a major boon for European investment and economic activity.

Asia is also viewed favourably, as State Street emphasises China’s new policies towards increasing domestic consumption and building out domestic AI capabilities in 2026.

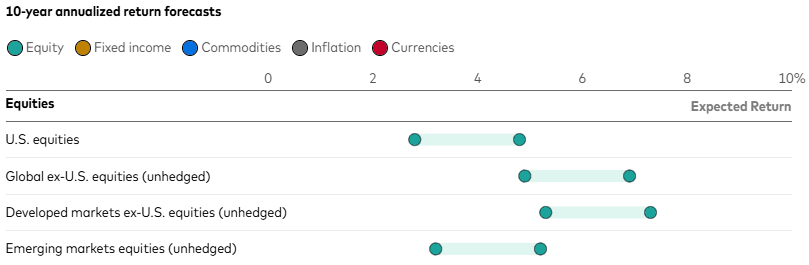

Vanguard believes an international preference is a long-term play, forecasting developed markets outside the US will outperform the US over a 10-year horizon:

Source: Vanguard Market Perspectives (Nov. 26, 2025)

Adviser takeaways:

The narrowing of the AI boom has some financial institutions looking to developed international markets outside the US to hedge against AI and benefit from macroeconomic and policy-driven growth.

Central Banks and Interest Rates

Most sources agree that the US Federal Reserve will reduce rates, with BlackRock, Betashares, and State Street all forecasting three 25 bp cuts to bring the US cash rate to 3.00%.

The European Central Bank has previously been expected to cut rates, but held them steady as the Eurozone economy held up against tariffs. The Associated Press believes rates may be held steady throughout 2026.

Japan may see rate holds or further increases in 2026, with the BOJ recently raising rates to a 30-year high of 0.75% on the back of sustained inflation; ING forecasts further rate increases.

Australian institutions are split on whether the RBA will hold or increase rates, but most agree rates won’t decrease in the near-term, which will increase the spread between US and Australian rates.

Adviser takeaways:

The Australian dollar stands to benefit from a weaker US dollar, with Betashares forecasting it could rise as high as US$0.70 by mid-2026 even without RBA rate hikes. Assuming the RBA holds or hikes rates, Australian bond yields are attractive, but property may become less attractive (see below).

Australian Property

Banks are split on whether the RBA will hold rates or increase rates. NAB forecasts two hikes to 4.10%, CBA forecasts one hike to 3.85%, while ANZ and Westpac forecast no rate hikes during 2026, but also no rate cuts.

Morgan Stanley takes a more dovish view as they forecast late-2026 rate cuts, stating “We don’t think you’ll see sufficient pressure near term to drive RBA rate hikes.”

The RBA itself says the rate will be held at 3.60% but will be data-dependent and could be hiked if inflation remains high.

APRA has clamped down on high-risk mortgage finance, placing limits on banks’ high debt-to-income loans. Banks also restricted trust lending as it was promoted on social media as a way to circumvent APRA’s mandated mortgage affordability tests.

As a result, analysts expect slower home price growth. AMP is forecasting between 5% and 7% growth in home prices following 8.5% growth in 2025. IG similarly forecasts a slowed housing market.

Adviser takeaways:

Forecasts are expecting subdued property price growth in 2026 as the RBA considers rate hikes and APRA has taken aim at high-risk mortgage lending.

Alternatives

Private markets are primed for a strong 2026 according to Morgan Stanley, JP Morgan, and BlackRock. Elevated public market valuations in public markets underscore the value of private equity. Several blockbuster IPOs are expected, including SpaceX, OpenAI, Anthropic, and Kraken, according to JD Supra.

Private credit is similarly attractive with direct lending offering yields above syndicated loans and providing stronger protections.

AI infrastructure build-out and global energy transition and security efforts are driving what BlackRock refers to as a golden age of private infrastructure investing.

State Street offers a more muted outlook on gold, stating that high prices and contained US inflation could reduce its value as a debasement hedge and decrease demand.

Crypto, namely Bitcoin, looks set to benefit from institutional integration and clearer regulation, as well as increased interest in Bitcoin ETFs, according to Coinbase, Fidelity, State Street, and Standard Chartered.

Adviser takeaways:

Private markets are offering attractive hedging against stretched public valuations, with private equity, credit, and infrastructure all expected to benefit from various tailwinds in 2026.

Gold may slump in 2026.

Big Theme: AI

Mark Zuckerberg of Meta has openly admitted he would rather overinvest in AI than risk missing out, and analysts think the same sentiment echoes within Amazon, Microsoft, and Alphabet. These four companies are forecasted by CreditSights to each spend over $100 billion on capital expenditures, equal to between 45% and 57% of revenue.

However, institutions are increasingly focusing on when AI will not just be transformative, but also profitable. Firms like T. Rowe Price are worried about the increasing use of debt finance for AI capex that has yet to be justified by returns.

Deloitte predicts agentic AI may be the path to profitability, forecasting that 75% of companies may invest in agentic AI platforms in 2026.

Adviser takeaways:

Major AI capex from the Magnificent 7 will almost surely continue in 2026, but profitability remains uncertain. As noted in the global markets segment, this has contributed to expectations that developed markets outside the US will outperform over the next decade.

Surprising Theme: Alpha over Beta

Fidelity International has deemed 2026 as the “Age of Alpha” as index-based beta exposure is no longer a neutral investment. With AI dominating indexes and market fragmentation increasing, Fidelity states beta isn’t good enough to provide stable returns; investors must pursue alpha and actively seek returns unconstrained by stylistic or geographic biases.

BlackRock echoes this sentiment, stating “there is no neutral stance, not even exposure to broad indexes”. They paint themselves as pro-risk and willing to continue riding AI gains, but believe the environment is primed for active investing.

What’s the logic behind this theme? April’s Liberation Day caused global markets to fall by roughly 20% according to Fidelity, exposing beta-heavy portfolios to be less diverse than had been believed. A 60/40 equities-bonds portfolio is not adequately stable if both asset classes can be impacted by one country adopting protectionist tariffs.

Adviser takeaway:

Fidelity International supports the concept of absolute return strategies, where fund allocations are not constrained by any index or market weightings, nor geographic biases. This provides returns that are uncorrelated with passive index tracking funds. As AI skepticism ticks up and profitability questions become louder, detachment from AI-heavy indexes may become a more popular strategy.

Thanks to Cboe for sponsoring this email

Cboe’s Manager in Focus: Paradice

M1DS – Paradice Australian Mid Cap Fund (Active ETF)

The Paradice Mid Cap Fund (M1DS) provides investors with high-quality exposure to the ASX mid-cap segment which is historically one of the strongest-returning parts of the Australian equity market. It is managed by an experienced team with a strong focus on downside protection, with the strategy investing in 40-60 carefully selected companies drawn from both emerging small caps as well as former ASX50 names undergoing turnaround.

Since launching in 2006, the strategy has delivered ~9.85% p.a., consistently outperforming its benchmark and generating long-term alpha across most market cycles. Mid-caps offer a compelling blend of growth and stability, and Paradice’s style-agnostic, research-driven approach makes M1DS a strong satellite allocation for investors seeking diversified domestic growth with proven risk-adjusted returns.

Missing out on mid-caps?

Advisors often focus on small-cap potential or large-cap stability. Jovana Gagic from Paradice Investment Management believes Australian mid-caps are overlooked and provide excellent opportunities for earnings growth, diversification, and structural tailwinds.

We sat down with Jovana to walk through the companies quietly graduating through the mid-cap ranks in our latest episode of Basis Points. (Spotify | Apple | YouTube)